2018 Asia-Pacific Market & Sectors To Watch (Top 5 Cities)

The survey results for this year’s Emerging Trends in Real Estate® Asia Pacific report reflect a combination of cross currents—some of them strikingly different—created by different types of investors as they pursue a range of different strategies. Most obviously, there is a growing divergence between investors embracing either growth- or yield-driven approaches: on the one hand are those looking to maximize returns in an environment where ever-growing competition has squeezed yields to historical lows. On the other hand are those—usually larger players fleeing near-zero returns in sovereign bonds—seeking stable long-term yields that may appear vanishingly low to investors pursuing more conventional investment strategies. Others still, meanwhile, are focused on tapping returns associated with long-term economic growth in developing markets like India and Vietnam. As one fund manager said: “We go in with a long-term perspective about being there for the next ten to 20 years and being part of this stellar demographic cycle. There is retail consumption, there is office demand, IT demand, domestic demand that hasn’t come out yet. So you talk about capital appreciation, finding the high yield and hoping for compression. And you also talk about being there for the long term, to be able to get 4 to 5 percent rental growth per year.” The fact that markets in Australia are able to satisfy two of these requirements at the same time—its gateway cities combine the appeal of a stable investment environment with a combination of relatively good current yields and the prospect of strong rental growth going forward—tick the right boxes for many investors in Asia and explain thestrong performances by both Sydney and Melbourne in this year’s rankings.

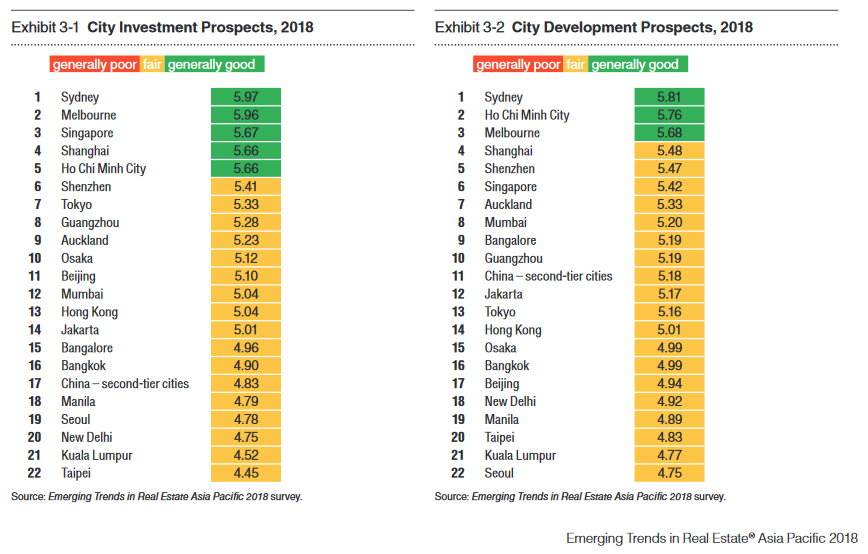

Top Investment Cities List (1st to 5th):

Sydney (first in investment, first in development).

In many ways, Sydney’s appeal is the same as it has been for years—as a major city in a mature economy, it is one of a handful of destinations in the Asia Pacific that combines a reasonably deep and liquid market of core assets with a better-than-average yield (for prime office, 5 percent or less). The big draw this year, however, is that Sydney is still able to offer strong rental growth, with projected net effective increases for office assets over the next three years of 5 percent annually, according to CBRE. Unsurprisingly, Sydney remains popular with international investors, who represented about a third of total transactions in the first half of 2017, according to JLL. The problem with Sydney, however, is actually finding core product to buy. Office transactions were down some 37 percent year-on-year in the first half of 2017, according to RCA, partly because many of the best assets have already been bought and partly because owners have little incentive to sell. That said, interviewees also spoke of a good supply of incoming stock from funds that will need to divest in order to take profits, with transactions likely to pick up in the second half of the year. With stabilized assets so hard to find, investors have adopted a number of strategies. Build-to-core and forward funding remain go-to approaches, while many existing owners (usually domestic funds) are also opting to redevelop older properties in their portfolios rather than trying to buy. As a result, Sydney also ranks first in the rankings for development prospects. A significant number of ongoing projects initiated by mainly Chinese developers to convert Grade-B offices to prime residential sites in the city center are also underway. With some of these now experiencing cash-flow problems as a result of capital control restrictions in China, a number of interviewees indicated potential for providing bridging finance to keep these projects moving forward. Another option many investors in Sydney, including foreign funds, are now willing to pursue is investing in outlying areas. According to one: “It’s incredibly hard to get access to high-quality real estate because it’s tightly held, so either you’re paying record cap rates or you’re going to secondary markets like Parramatta or North Ryde where there’s still a very attractive yield spread to the CBD.” New transportation

infrastructure is now making these out-lying districts increasingly appealing.

Melbourne (second in investment, third in development).

Melbourne’s appeal as an investment destination is very similar to Sydney’s—a mature market, high-quality core assets, and relatively good yields by Asian standards. Again, occupational markets remain strong, with high demand and little new supply leading to projected 5.5 percent annual net effective rental growth over the next three years, according to JLL. Prime office yields of around 5 percent are expected to compress further over the next couple of years as supply tightens in an environment of strong demand from both foreign and domestic buyers. As with Sydney, however, investors are having problems getting money into the market due to a shortage of stock available for sale. Office transactions having fallen already in 2016 dropped further in the first half of 2017, to around A$315 million, or about half the figure recorded in the first half of the previous year, according to CBRE figures. With strong demand continuing, yields are expected to compress further from the current level of around 5 percent. Residential prices in Melbourne have continued to rise (up 12.1 percent year-on-year in the first three quarters of 2017) in defiance of government containment efforts, driven by strong population growth and rising activity from international buyers, particularly from China. High prices paid for residential plots by Asian developers have also created additional pressure for future price rises, although buying has now fallen off following imposition of tighter rules on capital exports by the Chinese government. With new residential supply about to hit the market and tighter lending restrictions on mortgages leading to slower sales, expectations are rising that the market may have peaked.

Singapore (third in investment, sixth in development).

After two years of declining rents caused by a sluggish economy and a glut of supply, the promise of a bottom in Singapore’s office market has caused its ranking to soar from next-to-bottom last year to third in this year’s table. Office rents have firmed probably earlier than expected, while completion of the region’s second-biggest office deal in September 2017 has now galvanized the local market and set a floor for valuations. Several core office transactions have taken place this year, with foreign funds buying actively. Others, however, see talk of a bottoming as premature. According to one fund manager active in the market: “Singapore’s still in a difficult place. They don’t have a lot of business confidence, there’s quite a lot of supply and not a huge amount of expansion. It’s challenging to bring foreign workers in because the government has responded to local concerns to protect jobs, and at the same time a lot of the European banks are downsizing, which hits demand for space. I don’t want to be negative, but we’re not seeing a big pipeline of deals that interest us.” The residential sector is also showing signs of bottoming, with rising transactions and a slight uptick in pricing for the first time in four years. Driven by buoyant sentiment, sales of developer sites have surged amid tightening supply as developers add to land banks. The rebound seems likely to be sustainable, given the momentum of several years’ worth of pent-up consumer demand. Chinese developers have been especially active in buying land, pushing up land auction prices for residential sites significantly through 2017.

Shanghai (fourth in investment, fourth in development).

This year, Shanghai has performed better than expected. Transactions have been driven partly by surging demand from domestic buyers who have been barred from exporting capital as a result of a government regulatory crackdown, andpartly by foreign core funds flush with new capital they need to deploy. As a result, “overbidding has been crazy,” as one investor put it, with yields tightening to under 4 percent in some cases. That may seem unusually compressedfor a developing market, but Shanghai has probably transcended that status given it is already the epicenter forbusiness in China and probably destined to become a major global financial center sooner rather than later. Investors have always played the rental growth/capital appreciation card in Shanghai, often in defiance of conventional wisdom. Given strong ongoing demand for office space, there seems no reason at present to think it will not play out again, even if there is a lot of new supply in the pipeline. Another reason foreign core investors are now targeting China is that they know that build-to-core strategies will almost certainly find ready buyers in the form of Chinese insurance companies or other institutions happy to pay top dollar for good product. As was the case last year, a lack of available stock in prime locations is driving an increasing amount of current activity into fringe CBD or outlying parts of the city. Activity from opportunistic or value-add investors, meanwhile, has fallen as investors struggle to find product they can differentiate from what is already available in the market.

Ho Chi Minh City (fifth in investment, second in development).

With an economic trajectory thought to be similar to an early-day China, Vietnam now has “a wave of money swilling around” as large regional developers and an increasing number of private equity funds make the bet it will offer up a repeat of the Mainland China experience in terms of property price inflation. Bureaucracy remains an issue, but restrictions are slowly being eased and Vietnam today offers probably better market access than do other Southeast Asian developing economies. It remains a favorite of investors from South Korea and Japan. Most investors are focused on the residential sector. Home sales and pricing have been strong over the last three years, but in a volatile market there are signs the cycle may be peaking. As one investor in Ho Chi Minh City observed: “Land costs have gone up very, very significantly to the stage where it’s not an opportunistic play anymore in terms of the returns you can get. And when you look at how developers are taking downpayments on condos and using those to buy more land as opposed to putting them into their own projects, you can see there are strains in the system and that if the sales should slow, the train’s going to stop.” Given the small amounts of investable stock, those focused on the commercial side will be looking mainly at development, usually by way of joint ventures with local developers, who are often willing to take on partners to obtain better access to foreign capital and technical expertise. Completed assets do exist, however. With most existing stock having been built by domestic developers, there are now opportunities to buy and fix. According to one investor: “There are some questions around standards and design, so it’s probably a value-add play because you’d have to do some sorting out. We’ve just bought an office tower at 7 percent to 8 percent [yield] and a retail podium in a mixed-use development for just under 9 percent.” Opportunities also exist to provide debt financing, given the generally high gearing of many domestic developers.

This is an excerpt of PWC’s Emerging Trends In Real Estate of 2018 Asia-Pacific Edition.

You can read more about PWC’s Emerging trends of real estate 2018 and the other top cities to watch by downloading the PDF copy here.

–

No comments yet.