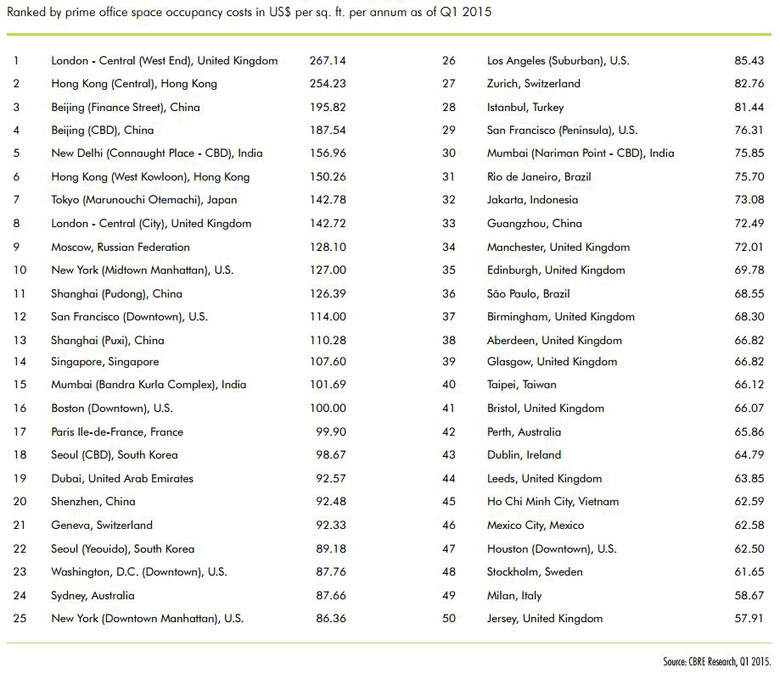

Asia Accounts for Four of Five Most Expensive Office Markets Globally

London’s West End’s overall prime occupancy costs topped the ‘most expensive’ list at US$267 per sq. ft. per year. Hong Kong (Central) followed in second place at US$254 per sq. ft. per year, which is the only market in the world–other than London’s West End–with a prime occupancy cost exceeding US$200 per sq. ft.

Beijing (Finance Street) (US$196 per sq. ft.), Beijing (Central Business District (CBD)) (US$188 per sq. ft.) and New Delhi (Connaught Place -CBD) (US$157 per sq. ft.) rounded out the top five.

The change in prime office occupancy costs mirrored the gradual recovery of the global economy. Overall global prime office occupancy costs rose 2% year-over-year, with Asia Pacific up 1.4%, reflecting the economic pressures that prevailed in the region over the past year.

“Occupier caution has declined and corporate confidence has been on the rise, and this confidence is starting to translate into a degree of expansionary momentum, ” said Richard Barkham, Global Chief Economist, CBRE. “At the same time, many office markets are increasingly short of the quality, modern, flexible and highly accessible or CBD-located office buildings which corporations are seeking to execute workplace strategies that will drive productivity and attract or retain talent.”

Henry Chin, Head of Research, CBRE Asia Pacific, comments, “in the Asia Pacific region, occupancy cost trends were mixed, with regional surveys showing stronger hiring intentions among employers in India, Taiwan, New Zealand, the Philippines and Japan while corporate hiring activity remained muted in other locations. India and the Philippines also continued to benefit from growing IT back office services looking for operational and costs efficiency. Throughout Asia, technology firms, business process outsourcing (BPO) firms and non-banking financial institutions are in expansionary mode, stimulating demand for office space. However, we are also seeing diverse occupier activity in the region with less expansionary markets–some occupiers are looking to optimize existing accommodations rather than expand.”

No comments yet.